Canada’s stunning landscapes aren’t just a feast for the eyes—they’re a canvas for our dreams. For many, that dream includes owning a home. But in the world of pre-construction properties, timing isn’t just everything—it’s the game-changer.

Navigating the pre-construction market is like solving a puzzle. It comes with its own set of challenges and rewards, demanding market savvy and strategic timing.

That’s where we come in.

We’re here to guide you through the pre-construction home buying process, helping you pinpoint that golden moment to make your move.

Get it right, and you could unlock both personal fulfillment and financial gain.

Ready to turn that Canadian dream into your address? Let’s dive in and discover when to make your pre-construction leap.

Understanding the Real Estate Market Cycles

Knowing how the real estate market changes is key when looking at pre-construction homes. Market cycles affect when it’s best to invest. By knowing the difference between buyer’s and seller’s markets, you can pick the right time for a pre-construction home.

Buyer’s Market vs. Seller’s Market

In a buyer’s market, there are lots of homes and not many buyers. This means developers might offer great deals to get people to buy.

But, in a seller’s market, there are more buyers than homes, which can make prices go up and make buying harder.

At the time of publishing this article, we believe it is still a buyer’s market. Buyers have all the leverage in the deal because interest rates are still high.

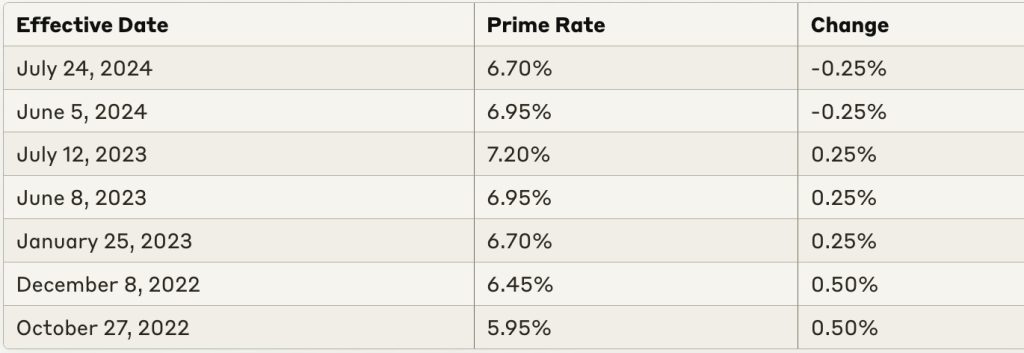

As of August 2024 – here are the rates from the last few updates:

Data in Chart Collected from Ratehub.ca

Compare the above to March 2020 – when the rates were hovering around 2.45% – a significant jump in a matter of 2 years that has held at this high position.

It is finally coming down – but still remains high and keeping the breaks. on the access to capital in the market which favours buyers.

Identifying Market Trends and Forecasts

Knowing what’s happening now and what might happen in the housing market is important for buying pre-construction homes. Looking at economic signs, changes in population, and forecasts can help you pick the best time to buy.

Understanding real estate market cycles helps buyers plan their pre-construction buys. This way, they can take advantage of good market times and get the best deals.

Preconstruction Pricing Strategies

Buying a pre-construction home means knowing how developers price their homes. They use tactics like early bird discounts and incentives to draw buyers. Knowing these strategies helps you make better choices and maybe get a good deal.

Early Bird Discounts and Incentives

Early bird discounts are a common pricing strategy. Developers give big price cuts to buyers who book early. This can save you a lot of money, so it’s smart to act fast.

Developers also offer incentives to attract buyers. These can be better finishes, extra parking, or cash back. Think about if these extras are worth it for you.

But remember, the discounts and incentives might not always be the best deal. Check the market and talk to real estate experts to see if they’re really good deals.

| Preconstruction Pricing Strategies | Description |

|---|---|

| Early Bird Discounts | Developers may offer significant price reductions to buyers who reserve their units early in the project’s lifecycle. |

| Developer Incentives | Developers may provide a range of incentives, such as upgraded finishes, parking spots, or cash-back promotions, to entice pre-construction home buyers. |

Understanding these strategies and looking at the offers closely can help you get a good deal on your pre-construction home.

The Advantages of Buying Pre-Construction

Buying a pre-construction home has many benefits. It lets you build equity and enjoy property appreciation over time. Pre-construction homes often grow in value faster than resale homes. This makes them a stronger financial investment.

Also, you can customize your home to fit your needs. You can pick the floor plans, finishes, and fixtures you like.

Building Equity and Property Appreciation

Buying a pre-construction home means locking in a price at purchase time. As the project finishes, your home’s value likely goes up.

This lets you build equity and enjoy property appreciation. In a growing market, this can mean big returns on your investment.

Customization Options and Floor Plan Selection

One big plus of pre-construction homes is the chance to customize your living space. You can choose from many floor plans, layouts, and finishes.

This makes your new home truly yours.

Investing in a pre-construction property offers great benefits. You get to build equity and experience property appreciation.

Plus, you can customize your living space and pick the perfect floor plan. These perks make pre-construction a great choice for those looking for a home that fits their life and financial goals.

Timing the Market for Best Time to buy a pre construction property

Buying a pre-construction home means knowing when to act. The best time to buy depends on the market – whether it’s a buyer’s market or a seller’s market.

By watching market trends, you can find the best time to invest.

In a buyer’s market, there are more homes for sale and less competition. This means you might get a better deal. On the other hand, in a seller’s market, homes sell fast and prices might go up. This could mean fewer discounts. Keeping an eye on local housing trends and new projects helps you pick the right time to buy.

Looking at the economy can also guide you on when to buy. When the economy is stable or growing, it might be a good time to sell. This is because people feel more confident about their investments.

As discussed above (and shown with the rate chart), the best time to buy is now as builders and resale property sellers will give the best prices.

The challenge with the buyer’s market will be the access to capital.

If you have capital (savings, equity, wealth) – then now is the best time to take a leap and get “discounted” prices for pre-construction real estate.

If you do “have” to sell, then pricing right (slightly below) average will generate the most interest from buyers in the market.

Knowing the real estate market well and choosing the right time to buy can help you make a smart investment.

This way, you can get a property that fits your goals.

Analyzing the Local Housing Market

When thinking about buying a pre-construction home, it’s key to look at the local housing market. Local housing market analysis, checking out new development projects and pre-construction inventory, gives you important info.

This helps you make a smart choice.

New Development Projects and Inventory

Watching the new development projects coming up helps you understand the future home supply. Knowing how many new homes are being built, when they’ll be done, and what types they are, lets you guess the market. This way, you can find the best time to buy your pre-construction home.

| Development Project | Estimated Completion | Unit Types | Pre-Construction Pricing |

|---|---|---|---|

| Riverdale Condos | Q4 2024 | 1-2 bedrooms | $350,000 – $500,000 |

| Oakwood Townhomes | Q2 2025 | 3-4 bedrooms | $550,000 – $750,000 |

| Lakeside Villas | Q1 2026 | 2-3 bedrooms | $400,000 – $600,000 |

Related: Check out our pre-con catalogue on the hottest properties out there in the market right now.

Looking at the pre-construction inventory in your area helps you spot if there’s too many or too few homes. This affects prices and how many homes are available. Knowing this lets you buy at the best time to get a good deal.

“Understanding the local housing market dynamics is crucial when considering a pre-construction home purchase. Staying informed about upcoming developments and inventory levels can give you a strategic advantage.”

Looking at the local housing market, including new development projects and pre-construction inventory, is key to finding the best time to buy a pre-construction home. By keeping up and being proactive, you can make a choice that fits your goals and the market.

Pre-Construction Condo Investment Opportunities

The real estate market in Canada is always changing. Pre-construction condo pre-sales are now a great way to invest. They let investors buy properties before they are finished. This gives them a chance to make money as the property’s value goes up.

Investing in pre-construction condos has its perks. Developers often give big discounts to early buyers. This means investors can get a good deal and make a lot of money later.

Looking into pre-construction condo investment opportunities means knowing the local housing market. It’s important to look at new projects and see where the market is going. This helps investors pick the best places to invest.

| Key Factors | Considerations |

|---|---|

| Developer Reputation | Check the developer’s past work, money stability, and how they finished projects. This helps make sure your investment is safe. |

| Location and Amenities | Look at where the property is, how easy it is to get around, and if it’s close to shops and jobs. |

| Market Demand | See how many people want condos there, think about job growth, and look at the area’s economy. |

Doing your homework and finding the right condo investment opportunities can help investors make the most of the real estate market. This way, they can reach their financial goals.

Pre-construction condo pre-sales are a great chance for investors to grow their money. By staying up-to-date, doing deep research, and matching investments with market trends, investors can make the most of the condo market.

Factors to Consider for Pre-Construction Purchases

When looking at pre-construction purchases, it’s key to check the developer’s reputation and the area’s future. These factors can greatly affect your investment’s value and future.

Developer Reputation and Track Record

Looking into the developer’s reputation is vital when buying a pre-construction home. Check their history, past projects, and what customers say. Make sure they’re known for building quality homes and sticking to timelines. A developer with a good name means you’re more likely to trust your investment.

Location and Neighborhood Analysis

The area and its surroundings are big factors in a pre-construction property’s value. Look at how close it is to shops, schools, and parks. Also, think about what the area might be like in the future. This could change the property’s value and how easy it is to sell later.

| Factor | Importance | Potential Impact |

|---|---|---|

| Developer Reputation | High | Ensures project completion, quality, and customer satisfaction |

| Location and Neighborhood | High | Affects property value, appreciation, and long-term livability |

Think about the developer’s reputation and the area’s future to make a smart choice. This way, you can meet your investment goals and get the most from your pre-construction buy.

Pre-Construction vs Resale: A Comparative Analysis

Choosing between pre-construction and resale homes is a big decision for real estate investors in Canada. Both have their own benefits and things to think about.

Pre-construction homes might grow in value more and let you customize them. But, they could also face delays and unexpected problems. Resale homes are ready to move into right away and have a known history. They might not let you change things much and could not grow in value as much.

| Factors | Pre-Construction Homes | Resale Homes |

|---|---|---|

| Pricing | Often lower initial prices, with potential for appreciation | Prices reflect current market conditions |

| Customization | Ability to customize layout, finishes, and features | Limited customization options |

| Possession Timeline | Longer waiting period before move-in | Immediate possession |

| Construction Risks | Potential for delays and defects | No construction-related risks |

When looking at pre-construction vs resale homes, think about what you want from your investment, how much risk you can take, and the market.

Choosing between pre-construction and resale homes needs a good look at the pros and cons of each. Understand the local real estate market and your investment plan. This way, Canadian buyers can pick the best option for their money goals and risk level.

“Investing in real estate is not just about the property itself, but also the market conditions and your overall investment strategy. A thorough comparative analysis is crucial to making the best decision.”

- Understand the local real estate market trends and forecasts.

- Evaluate the developer’s reputation and track record for pre-construction projects.

- Consider the potential for property appreciation and long-term value growth.

- Weigh the risks and challenges associated with each option, such as construction delays or immediate possession.

- Align your investment objectives and risk tolerance with the characteristics of pre-construction and resale homes.

Financing Options for Pre-Construction Homes

Buying a pre-construction home is exciting but needs a special way to finance it. Financing for pre-construction homes includes mortgage pre-approvals, deposits, and special financing. Knowing these options helps you get your dream home.

Mortgage Pre-Approvals and Deposits

Getting a mortgage pre-approval is key when financing a pre-construction home. You work with a lender to see how much you can borrow and get a pre-approved rate.

Mortgage pre-approvals show builders you’re ready to finance your home, making you stand out in the market.

Deposits and down payments are also important for financing pre-construction homes. Builders often ask for a big deposit, usually 10% to 20% of the home’s price.

You can pay this in bits, making it easier to handle the cost.

Knowing about financing options for pre-construction homes helps you make a smart choice.

Think about your mortgage pre-approvals and deposits to move through the process easily.

Legal and Contract Considerations

Buying a pre-construction home means you must look closely at the legal and contract terms. This ensures your rights and interests are safe.

The legal stuff for buying before construction is complex. But knowing it helps you make a smart choice.

One important thing to think about is the contract terms and conditions. These are legal papers that tell you what you and the developer must do.

Make sure to check things like when the project will finish, what warranties you get, and the developer’s past work.

- Read the pre-construction contract well to know your buyer protections, like getting your deposit back and what the developer must do.

- Talk to a real estate lawyer to make sure you get the legal stuff and protect your money.

- Look into the developer’s reputation and past work to see if they are reliable and make good homes.

By looking at the legal considerations for pre-construction, you can feel sure and make a choice that fits your future plans.

“Buying a pre-construction home needs careful look at legal and contract details. Take time to know your rights and duties as a buyer. Work with a smart real estate pro for a smooth and good deal.”

Risks and Challenges of Pre-Construction Buying

Buying a pre-construction property comes with risks and challenges. You need to know about construction delays and quality deficiencies. These can affect your investment. It’s important to be aware and take steps to reduce these risks.

Construction Delays and Deficiencies

Construction delays are a big worry for buyers. Things like bad weather, supply chain problems, or permit delays can cause delays. This can be frustrating and costly for buyers.

Quality deficiencies are another issue, where the home doesn’t meet your or industry standards.

- Look into the developer’s past work to see if they’re known for being on time and high quality.

- Check the construction timeline and what the developer plans if there are delays.

- Think about hiring a home inspector to check the property before you buy, to spot any quality problems.

Being proactive and doing your homework can help you avoid some of the risks of construction delays and quality deficiencies.

“Buying a pre-construction home can be exciting, but knowing the risks is key. With careful research and the right professionals, you can lower these risks and make a good investment.”

Buyers need to think about the pros and cons before deciding. Knowing the risks of pre-construction buying helps you make a smart choice and protect your investment.

Conclusion

Starting to buy a pre-construction home is a big step. This article has shown how important it is to plan and research well. Knowing about the real estate market cycles and the local housing market is key to making good choices.

When looking at pre-construction homes, think about the builder’s reputation, how to finance it, and legal stuff.

Look at the location, what it offers, and possible delays in building. This way, you can choose a home that fits your future plans and investment goals.

Buying a pre-construction home has its ups and downs. This article’s tips can help you know the best time to buy. You can gain equity, see your property grow in value, and customize it. Approach this journey with confidence and hope your home investment does well!

FAQ

Q: What is the best time to buy a pre-construction property?

A: The best time to buy a pre-construction property depends on the market. Look at if it’s a buyer’s or seller’s market. Also, check out upcoming projects and how many properties are available. Choosing the right time can help you get a good deal.

Q: What are the benefits of investing in a pre-construction condo?

A: Buying a pre-construction condo has many perks. You can build equity and customize your home. You might also see the value go up. But, make sure to look at the housing market and development plans first to find the best deals.

Q: How can I assess the reputation and track record of a pre-construction home builder?

A: It’s key to check out a builder’s reputation and past work. Read reviews and look for awards. Make sure they have a history of quality work to ensure a good investment.

Q: What are the risks and challenges associated with buying a pre-construction home?

A: Buying a pre-construction home can come with risks like delays and quality issues. You might also face problems with financing. Always read the legal stuff carefully and have a plan to deal with these issues.

Q: How can I finance the purchase of a pre-construction home?

A: Financing a pre-construction home means getting a mortgage pre-approval and saving up for a big deposit. Look into your options, understand the terms, and make sure you have enough money to buy the property.

Q: How do I analyze the local housing market for pre-construction opportunities?

A: To find good pre-construction deals, study the local housing market. Look at new projects, how many homes are for sale, and market trends. This helps you pick the best time to buy and find great investment chances.

Source Links

- Infra, construction sector continue to remain attractive for long term: Sudip Bandyopadhyay – https://m.economictimes.com/markets/expert-view/infra-construction-sector-continue-to-remain-attractive-for-long-term-sudip-bandyopadhyay/articleshow/112136690.cms

- Orange County welcomes H.B. Neild Construction’s new local investment – Orange Leader – https://www.orangeleader.com/2024/07/30/orange-county-welcomes-h-b-neild-constructions-new-local-investment/

- Richmond County School System reviews plans and procedures ahead of new school year – https://www.wjbf.com/news/richmond-county-school-system-reviews-plans-and-procedures-ahead-of-new-school-year/

- Here’s What You Can (And Can’t) Negotiate on a New Construction Home – https://www.homelight.com/blog/buyer-buying-new-construction-home-negotiation/